What is Stablecoin? A complete Guide on How to Create it on XinFin Blockchain Network.

Volatility in the prices of cryptocurrencies has resulted in the ability to use them as a seamless medium of exchange. A key hurdle for the adoption of cryptocurrencies has come up with a solution called StableCoin, which is designed to achieve price stability while retaining the main components of cryptocurrencies.

This article is intended to understand what is Stable Coin, why do we need it to create on XinFin Network, and what are its real-world applications.

We shall discuss the following topics in the article:

1.What is StableCoin? 2.Types of StableCoins 3.Why StableCoin to be deployed on XinFin Network? 4.Real-World Applications of Stable Coins

What is StableCoin?

Stable coins aim to bridge the gap between cryptocurrencies’ benefits and the stable nature offered by fiat currencies. It is a crypto token with a value pegged to the price of a national currency to combat its volatility.

Now, the question is, why do we need a stable coin.

Though cryptocurrencies are global currencies, coins like Bitcoin and Ether are volatile. The price of Bitcoin raised from $1000 to $20000 during 2017. Since it is not sustainable, users and investors require more stability in the market.

Imagine that you pay $30 for dinner today and the same amount would be worth $40 tomorrow because the value of that crypto token went up. Small investors cannot handle that kind of volatility. Therefore, stable coins emerged as a new technique to drive the new way of adoption to cryptocurrencies. Stable coin like USDT by tether have become very popular in recent times. As per coinmarketcap.com’s data USDT is the top5 most popular coin in terms of market capital.

You might think why do we need to create fiat-backed crypto tokens instead of just using fiat currency. Decentralized currencies do not require any centralized authority to bring trust in the system, thereby reducing additional costs involved.

Also, cross border payments can be made quickly with XinFin Network. Backing crypto tokens by XinFin Network with stable fiat currency or assets can add more value and build more trust among investors and users.

What are the types of StableCoins?

Stable Coins are of four types:

1.Fiat-backed Stable Coins 2.Non-collateralized Stable Coins 3.Cryptocurrency-backed Stable Coins 4.Commodity-collateralized Stable Coins

Fiat-backed

Fiat backed stablecoins are crypto tokens associated with the value of a specific fiat currency. These tokens hold their value fixed at a 1:1 ratio.

For example, MRP is a stable coin, which is pegged 1:1 to the US dollar. Fiat currency is deposited as collateral to ensure the existence of a fiat-backed stablecoin. As a result, it requires financial custodian and regular auditing to determine that the token always remains collateralized.

Non-collateralized

non-collateralized stablecoins are based on the concept of a Seigniorage Shares system. Seigniorage is the difference between the value of money and its printing cost.

These coins depend on the algorithm, which changes the supply volume to control their price. Using smart contracts, these stable coins are sold if the price falls below the pegged currency and more tokens are supplied to the market if its value rises above the pegged currency.

Cryptocurrency-backed

Cryptocurrency-backed stable coins work similarly to that of a fiat-backed stablecoin. However, it locks up cryptocurrency as collateral instead of using fiat currency. For example, XDC can be kept as collateral to create a cryptocurrency-backed stablecoin.

These tokens use a security pledge to compensate for the volatility of cryptocurrency to be used as collateral. It states that the stablecoin will not be based on a 1:1 ration for the crypto collateral..

For instance, if a cryptocurrency-backed stablecoin is pegged to the US dollar, it can be something around $2 peg for each $1 coin issued.

Commodity-collateralized

Commodity-collateralized stablecoins are backed by other types of interchangeable assets like real estate and precious metals. Gold is one of the most common commodities to be collateralized.

Commodity-backed stable coins hold a tangible asset with some real value. These commodities can appreciate value over time, which offers an increased incentive for people to use and keep these coins.

Using commodity-collateralized stable coins, anyone can invest in real estate properties or precious metals across the world. Generally, the investment in such assets is only reserved for the wealthy class of investors. However, stablecoins open up investment opportunities for average individuals globally.

Why Stable Coin to be deployed on XinFin Network ?

A stablecoin is a cryptocurrency that offers low volatility against the world’s major national currencies, unlocking the benefits for decentralized technology. In a nutshell, stablecoins can be defined as a cryptocurrency with a fixed price.

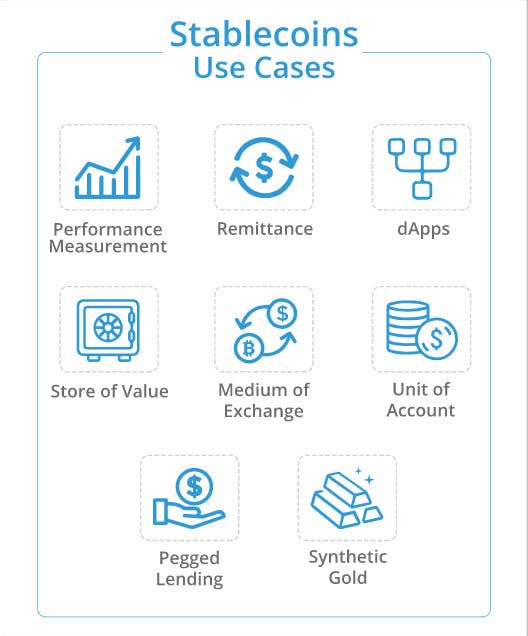

A reliable stablecoin offers a number of use cases than that of the XinFin blockchain. People no more need to worry about the fluctuations in prices of the cryptocurrency daily while buying them. Stability in cryptocurrencies allows people to transact quickly and it also enables other crucial financial functions, including credit and loans.

Moreover, a stable decentralized currency could become a global currency by allowing trustless and cross-border transactions. It will especially benefit people residing in countries with unstable monetary systems like Argentina. Therefore, stablecoins emerge as a new option for investors who want to make a transaction via a global currency, providing access to all.

The adoption of stablecoins will support the capital market formation and present new opportunities for decentralized finance on the XinFin blockchain like derivatives markets and lending.

For instance, the introduction of stable coins can also offer decentralized cross-border lending. It overcomes the problems encountered due to high volatile cryptocurrencies, which creates the lending process uncertain because lenders and borrowers cannot plan for the future safely.

XinFin proved its potential for global crowdfunding campaigns, but many of those projects faced issues as they had to manage financial plans because of the volatility in assets. With stable coins, inefficiencies can be removed from the cryptocurrencies by stabilizing its value.

Now, it is clear why do we need stablecoins; let’s understand some of its real-world applications.

Real-World Applications of Stable Coins

Protection from local currency crashes

In case, the fiat currency crashes in value; local citizens can exchange the crashed money for EUR-backed, USD-backed, or asset-backed stablecoins before they lose their savings. In this way, people get protected from further drops in the value of the local currency.

For example, currently, Venezuela is facing hyperinflation. The prices of goods in that country have been doubling almost every week on average.

The annual inflation rate at the end of 2018 in Venezuela was 80,000%. Most of the citizens cannot even afford food as their savings became worthless and the value continued to drop with each passing day.

Stablecoins can offer an ideal solution to all such people by allowing them to exchange their dropped currency holdings with a stable currency.

A day-to-day currency

Stablecoins can be used like any other currency for day-to-day purposes. From buying morning coffee to transferring funds to the family, we can use a digital wallet to pay with stable coins.

The stable currency is especially beneficial for overseas payments, as there is no need to convert different fiat currencies. A person in China could receive USD-backed stablecoins without converting them into Yuan.

Simplifying P2P and recurring payments

Stable coins enable the use of smart financial contracts that exist on a XinFin network and do not require any third party or centralized authority to execute.

Such automatic transactions are transparent, irreversible and traceable and therefore, are ideal for loan payments, salary, subscriptions and rent payments.

For example, an employer can deploy a smart contract that automatically transfers stable coins as a salary to employees at the end of the month. It is especially helpful for organizations that have employees all over the world. It will reduce the high fees and a long process of exchanging fiat currency from a bank account in New York to a European bank account.

With stable coins, this process could only take a few minutes and require a small fraction of transaction fees.

Enhanced cryptocurrency exchanges

There are only a few cryptocurrency exchanges that support fiat cryptocurrencies because of strict regulations. However, the use of stablecoins allows exchanges to overcome this problem by offering crypto-fiat trading pairs.

Users can use USD-backed stablecoin instead of using actual dollars. It will lead to the increased adoption of cryptocurrency trading as the process of obtaining cryptocurrency becomes easier for newcomers. Also, they can think about trading in terms of dollars or stable assets rather than fluctuating values of cryptocurrencies like Bitcoin.

Quick and affordable remittances for migrant workers

Today, migrant workers send payments through platforms like Western Union to transfer money back to their loved ones and family. This complete process is quite expensive and slow due to which families lose a big chunk of funds due to high fees.

Though XinFin is the best solution to this issue with almost zero fees and fast transaction, a cryptocurrency such as Bitcoin can drop in value by 20–30% in just one or two days.

Stablecoins can be a better alternative to this problem as workers and their families can use digital wallets across the globe to transfer stablecoins instantly with almost zero fees and no volatility.

If you are looking to gain the trust of investors by creating a stablecoin backed by XinFin Network or fiat currency,

Please checkout quick Stable coin Creation and Management Resource. Reference Medium Link:- medium.com/@arora.5195/stable-coin-deployme..

Quick Video link: How to Build Stable Coin on Blockchain Network

Other useful Tools:

XDC Mobile Wallet: Mobile based wallet to Send/Receive Stable coin Tokens

XINPAY: Web based Wallet to Send/Receive Stable coin Tokens

XDC Remix: XDC Remix is a powerful, open source tool that helps you write Solidity contracts straight from the browser.